Understanding Special Needs Trusts

When planning for a child with a disability in New York, selecting the right type of Special Needs Trust (SNT) is crucial. The correct trust preserves eligibility for essential benefits like Medicaid and SSI, while allowing your child to receive financial support and maintain quality of life.

What Is a Special Needs Trust?

A Special Needs Trust is a legal arrangement that holds assets for a person with a disability, without jeopardizing their eligibility for means-tested government benefits. There are two main types:

1st-Party Special Needs Trusts

Definition: A 1st-party SNT is funded with the beneficiary’s own assets. Common sources include:

· Personal injury settlements

· Direct inheritances

· Child support payments

Key Features:

· Medicaid Payback: After the beneficiary’s death, any remaining funds must be used to reimburse the state for Medicaid benefits provided.

· Establishment: Can be set up by a parent, grandparent, legal guardian, or the court.

· Age Limit: Must be created before the beneficiary turns 65.

When to Use:

· Your child receives assets in their own name.

· You want to preserve Medicaid and SSI eligibility without spending down those assets.

3rd-Party Special Needs Trusts

Definition:

A 3rd-party SNT is funded with assets belonging to someone other than the beneficiary, typically parents, grandparents, or other relatives

Key Features:

· No Medicaid Payback: After the beneficiary’s death, remaining funds can go to other family members or charities.

· Estate Planning Tool: Ideal for leaving an inheritance or gifts to a child with a disability.

· Flexibility: The creator controls how and when funds are distributed.

When to Use:

· You are planning your own estate and want to leave assets for your child.

· You wish to supplement your child’s quality of life without risking their benefits.

· You want to decide what happens to the trust’s remainder after your child’s lifetime.

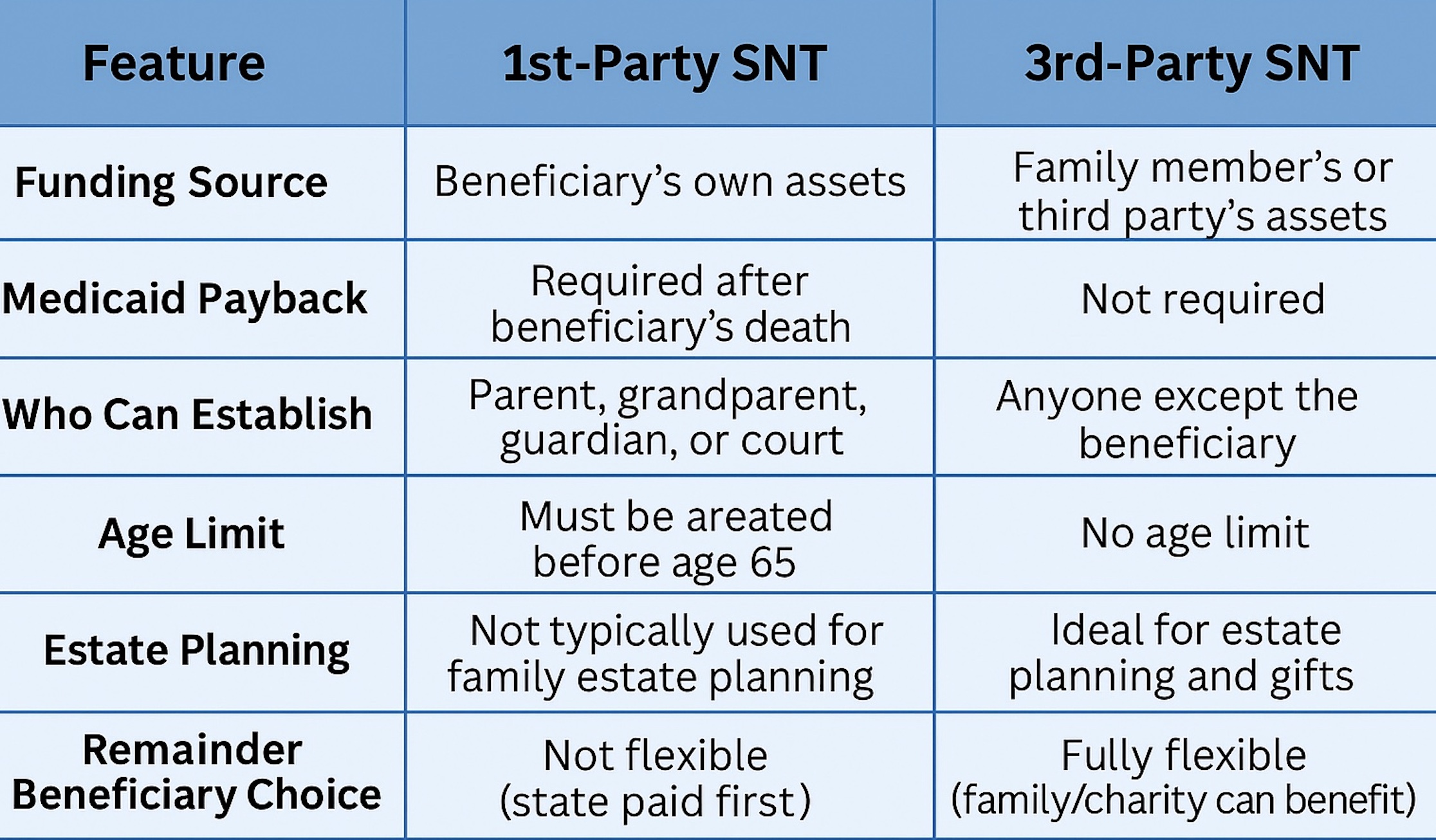

Comparison Table: 1st-Party vs. 3rd-Party Special Needs Trusts

Why Choosing the Right Trust Matters

Selecting the wrong trust can result in:

- Loss of Medicaid or SSI benefits

- Mandatory repayment of benefits received

- Reduced flexibility in managing and distributing assets

Mistakes in trust planning can be costly and irreversible. Professional legal guidance is essential to safeguard your child’s future.

What Happens If You Wait?

Delaying the creation of a Special Needs Trust can lead to:

- Immediate Loss of Benefits: If your child receives assets outright, they may lose Medicaid or SSI until funds are spent down or properly transferred.

- State Control: Without a trust, the state may dictate how assets are used or distributed.

- Family Conflict: Lack of planning can cause confusion and disputes among family members during emergencies or after your passing.

- Missed Opportunities: Early planning allows you to maximize your child’s quality of life and ensure long-term security.

Acting early ensures your child’s well-being and your peace of mind.

Frequently Asked Questions

1. Can I fund a 3rd-party SNT with my own assets while I’m alive?

Yes, you can contribute to a 3rd-party SNT during your lifetime or through your will.

2. What happens to a 1st-party SNT after my child passes away?

Any remaining funds must be used to reimburse Medicaid before any other beneficiaries receive assets.

3. Is it ever too early to set up a Special Needs Trust?

No. Early planning maximizes options, protects benefits, and reduces stress for your family.

4. Can grandparents or other relatives contribute to a Special Needs Trust?

Yes, but contributions should go directly to a 3rd-party SNT to avoid unintended loss of benefits.

5. Where can I find more information or support?

Visit the NYS Office for People With Developmental Disabilities or consult with a special needs attorney.

Take Action: Protect Your Child’s Future Today

Don’t wait until a crisis occurs. Early legal planning empowers your child with a disability, safeguards their rights, and ensures you can support them when it matters most.

Contact Sverdlov Law PLLC today at www.sverdlovlaw.com or 212-709-8112 or book a time on our calendar https://calendly.com/rochelle-sverdlovlaw/15min for a FREE evaluation of your case and get started with a plan tailored to your family’s needs.

This information is provided as a general overview and does not constitute legal advice. For personalized guidance, consult a New York special needs attorney.